All Post

White-Label Solutions vs. building your own Payment Platform

Introduction

At Vangwe, we frequently work with business owners who are eager to take greater control over their payment processing platform as their companies scale. Many businesses start with white-label third-party platforms, which offer a quick and cost-effective entry into the payments space without significant upfront investment. However, as these businesses grow, they often encounter limitations —whether in terms of features, customization, or scalability—that hinder them from reaching their full potential.

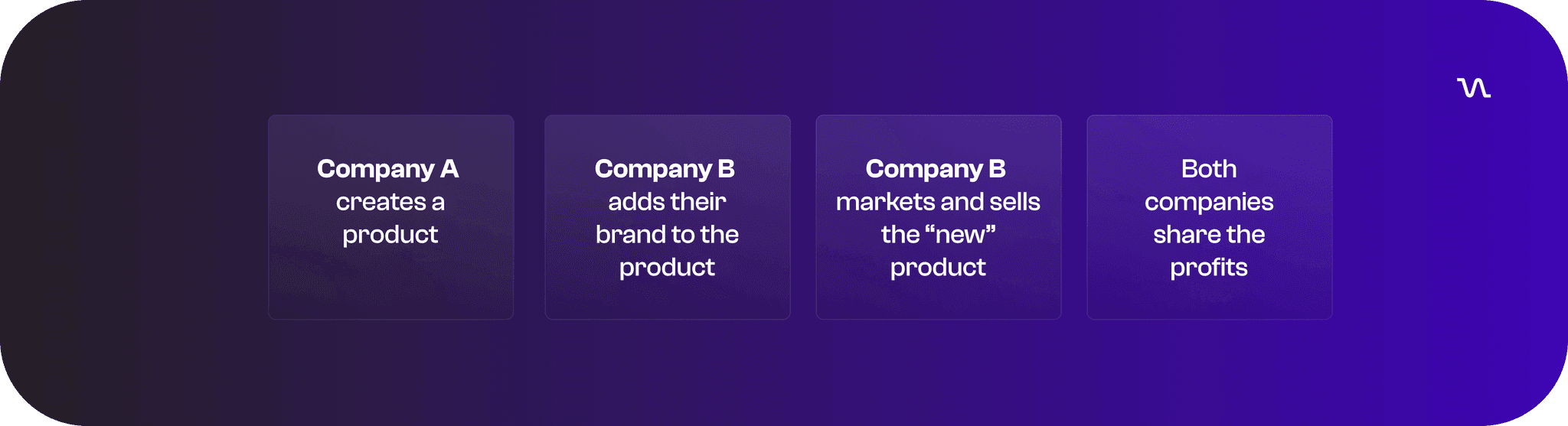

What Exactly is a White-Label Solution?

A white-label solution allows companies to rebrand and offer a third-party product or service as their own. In the case of payment processing, a white-label platform lets businesses provide payment services without building their infrastructure from scratch. This option is popular because it significantly reduces development costs and time to market. However, as companies grow, they may find that relying on a white-label provider limits customization, control, and the ability to scale or integrate new features efficiently.

FAQs we encounter in these conversations

1. What are my options beyond a white-label platform?

Many companies believe they have only two choices: either continue with a third- party platform or build their own payment system from scratch. In reality, the decision is not as binary. You can either negotiate the best possible terms with your existing white-label provider or strategically invest in developing your own platform.

But why not consider a hybrid approach? In our experience, businesses that attempt to combine elements of a third-party system with custom development often face more complexity, higher long-term costs, and limited control. While a hybrid approach may offer short-term flexibility, it tends to lack the strategic clarity needed for sustainable, long-term growth. However, this does not mean that there will be a transition period where they will slowly move their current clients from the old platform to the new platform.

2. Should I stick with a third-party platform or build my own?

The answer depends on your company's current needs and long-term vision. If you can secure a favorable deal with your white-label provider that guarantees scalability, continuous feature development, and manageable costs, then staying with the third-party solution might be the right move—especially if your business is not yet ready for the commitment that building your own platform entails. Still it would help if you always kept in mind that there might be a scenario where you White-Label Solutions vs. building your own Payment Platform 3 need an integration to a specific payment method that the white-label provider won't commit to do.

However, if your current provider's limitations are stifling your ability to scale or differentiate in the market, it may be time to invest in building your own system. Creating your own platform allows you to fully customize the user experience, incorporate unique features, and gain full control over your payment infrastructure. This is particularly relevant when expanding into new markets or supporting specific payment methods that are crucial to serving key clients in different regions. Another thing to keep in mind is that clients will usually feel more comfortable working with you if they know you have complete control over the platform where the payments are being processed.

3. What does it really cost to build my own payment platform?

Building your own payment processing system might seem overwhelming, but understanding the full scope helps businesses make more informed decisions.

Key cost considerations include:

Development: Creating a custom platform requires a team with deep expertise in fintech, payments, and compliance. While the initial development costs are higher, you gain complete control over the platform's features and performance. You can either handle this with your in-house team or outsource it to a software company specializing in fintech and payment product development.

Compliance and Security: Managing payments comes with strict regulatory requirements such as PCI DSS, GDPR, and other security protocols. Compliance can be costly but is essential for maintaining customer trust and avoiding costly penalties.

Maintenance and Support: A payment platform requires ongoing updates, monitoring, and support to ensure security, efficiency, and adaptability to changing customer needs.

While developing your own system requires a substantial investment, it provides unparalleled flexibility, scalability, and long-term return on investment for businesses with clear growth strategies. Moreover, if you identify the need to pivot White-Label Solutions vs. building your own Payment Platform 4 your payment processing focus, this approach allows you to adapt and implement changes whenever it suits your business needs.

Benefits of owning your payment infrastructure

By developing your own platform, you're no longer dependent on the limitations of a third-party provider. You can prioritize the features that matter most to your customers, customize the user experience, and scale your operations at your own pace. Just as importantly, you gain control over long-term costs rather than being subject to unpredictable price increases or hidden fees imposed by thirdparty providers.

At Vangwe, we've helped numerous businesses navigate these critical decisions. Whether you're assessing the terms of your existing white-label agreement or considering the leap to building your own platform, we're here to provide the strategic and technical support you need.

Making the right choice for your payment platform

The choice between continuing with a third-party provider and building your own platform is a pivotal one. Both approaches have their merits, but committing fully to one path will better serve your business in the long run. If you're ready to make White-Label Solutions vs. building your own Payment Platform 5 a decision or want to explore what it takes to build your own payment platform, we're here to help.

Stay tuned for more insights into payment systems, and feel free to reach out if you're facing similar challenges. At Vangwe, we're ready to help you build the right solution for your business.